Legal advertising on OTT

Research

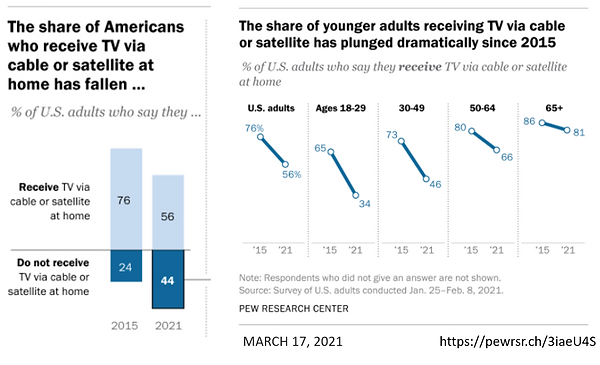

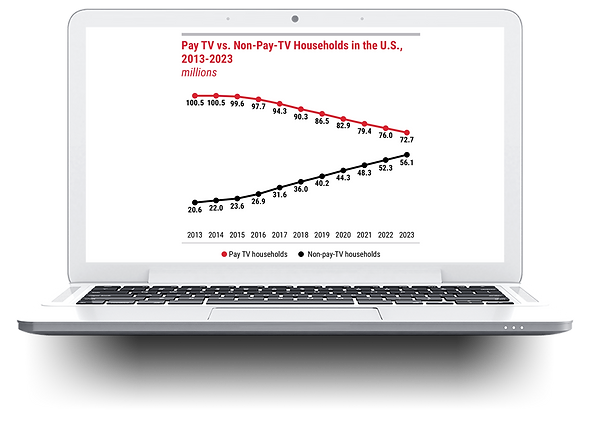

US households are sharpening their scissors, traditional cable subscriptions continue two erode.

By 2023 pay cable will be in less than 50% of US households.

The largest decline in traditional cable subscriptions was in 2020 dropping by 7.7%

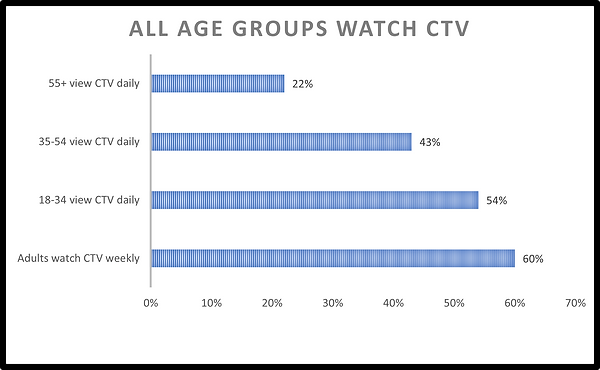

Your customers and clients are watching CTV. All age groups are tuning in.

60% of adults view CTV weekly this chart highlights daily viewing by age group.

Source LRG April May 2021

The CTV numbers speak loud.

Adoption of CTV | OTT | Streaming is overwhelming.

82% of US homes have at least 1 CTV device and 55% have a stand-alone device like a Roku.

The mean US HH has 4.1 CTV devices

2021 Emmy's Streaming shows reign supreme over broadcast and cable. This has been the trend for a few years. In 2021 7 of 10 shows with the top number of nominations are streaming only.

Time spent Streaming Q1 2021 increased 36% according to Conviva

There are many different cable & satellite penetration numbers floating around. According to the Pew Research Center, a credible source. As of Feb 2021, cable & satellite penetration or at 56%. Here is a breakout by age range. https://pewrsr.ch/3iaeU4S

FAST -free ad-supported streaming TV is growing briskly. Pluto, Tubi, & Roku are the most popular with viewers. All of these are 100% free and overflowing with content: live news, sports, movies, some originals.

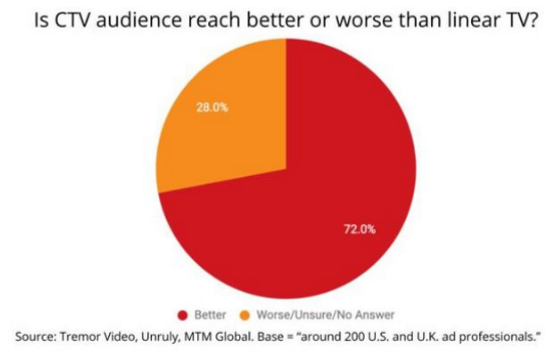

Dec 2020 Study by Tremor,, Unruly & MTM Global shows that almost 3/4 (72%) of US advertising professionals, brands and agencies, believe that CTV reaches target audiences more effectively than linear TV. 85% making CTV a key part of their video strategy. Full article here https://bit.ly/2Q3prVm

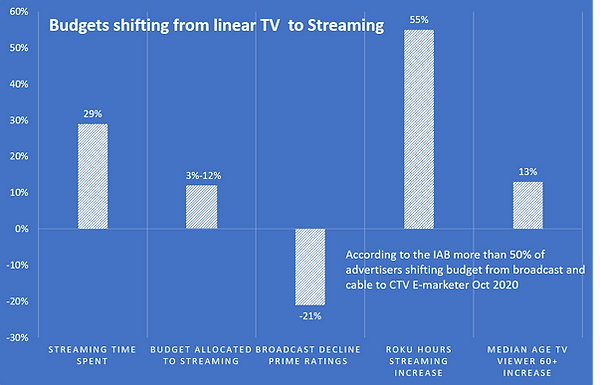

TV and Cable budgets shifting to CTV. IAB poll from Nov 2020 indicates 60% of advertisers plan to shift some budget to CTV.

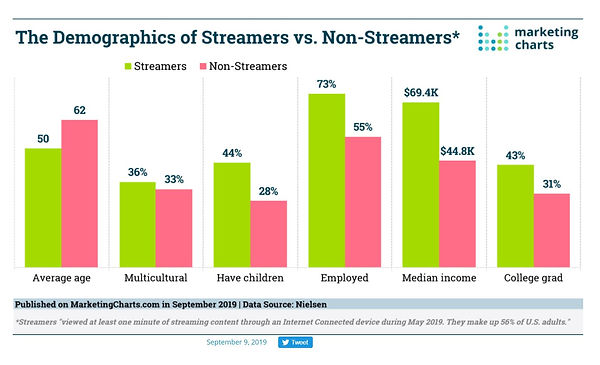

There is a lot to like about CTV Viewers: Younger, diverse, employed, better educated with children in the house.

Good to great, 2020 was a strong year of growth for CTV. 2021 will be a breakout year. Advertisers are starting to purchase advertising the way their best audience consumes it.

CTV always getting better for advertisers and viewers. Free AD- Supported CTV Networks (FAST) growth has been turbocharged by the pandemic. Millions are now watching.

CTV reaching and influencing all age groups. The average age of TV viewer 60+, the average age of CTV viewer 45

CTV way past the tipping point. It is now the viewer's default choice of viewing

CTV viewers fine with AD's. They are 60% more likely to choose the free version with ads than pay for a subscription.

CTV | OTT Ad-Supported Viewer Profile- Younger than linear TV 40% 38-53, more diverse, higher income, children in the home.

CTV | OTT HH will reach parity with pay HH. There are 97 million CTV | OTT HH compared to 89 million Cable Households.

The average HH has 3 connected devices. Smart TV's have the highest device penetration but Roku dominates viewing hours.

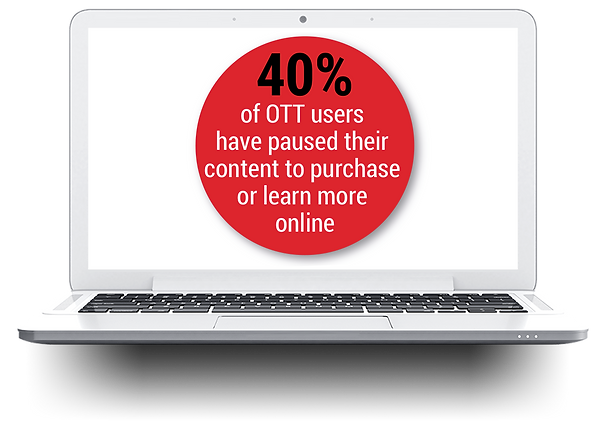

Engagement

high attention = high Intention

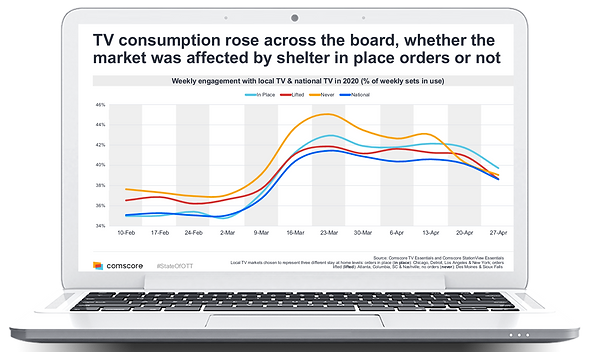

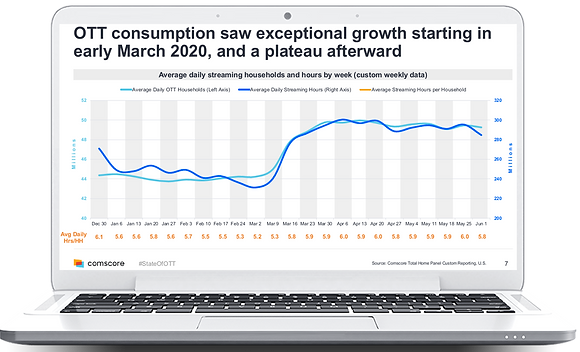

Comscore State of OTT June 2020. Traditional TV consumption increased at the onset of the COVID pandemic but by late April started to drift back to traditional viewing levels.

Just like traditional TV, CTV | OTT viewership skyrocketed during the COVID pandemic. Unlike TV, CTV | OTT is holding on to viewership gains in Households and Hours consumed.

Ad-Supported leads subscription-based CTV | OTT in total numbers and growth Jan to March 2020. Comscore OTT intelligence March 2020

CTV | OTT is mainstream. The Average home watches over 100 Hours per month. Comscore OTT intelligence March 2020

CTV |OTT penetration +333% Hard Wired Cable-25% over the last decade

Leichtman Research Group https://bit.ly/2Ci810s

CTV | OTT A 18-35 55% watch Daily, A 35-54 48% watch Daily Leichtman Research Group June 2020 https://bit.ly/2Ci810s